The process of filing for bankruptcy can seem daunting. The uncertainty behind the process often drives the fear of the unknown, which keeps many people from taking the steps needed to file bankruptcy. Pulling back the curtain and knowing what to expect when filing for bankruptcy can help clear up any myths or misconceptions surrounding bankruptcy.

It can be difficult for someone to admit that they need financial help. Many see filing bankruptcy as admitting failure or hitting financial rock bottom, when in fact it’s a chance to start again, fresh.

If you have decided filing for bankruptcy is right for you, the first step is whether to hire a lawyer to help you through the process. It is possible to file a bankruptcy case and go through the process without the assistance of an attorney but paying a legal professional to handle the paperwork and necessary steps will ensure that the case moves along smoothly. Bankruptcy law is complex and making a simple mistake on one or more of the forms submitted can result in the case being dismissed or rejected from the start.

The initial process of filing for bankruptcy involves a series of steps that must be followed. What these steps entail depends on the type of bankruptcy case being filed.

To qualify for Chapter 7 bankruptcy, the filer must pass the means test. Through this test, the filer must show that his or her income is less than the median income for the State of Florida. A Chapter 7 bankruptcy case discharges most of the filer’s personal debts, with the exception of a handful of others, such as tax debts, spousal support, and student loan debt. The bankruptcy trustee will take the assets not covered by exemptions and will sell these assets, using the proceeds from them to pay off qualifying debts. If the individual does not qualify under the means test, he or she can pursue a Chapter 13 case.

To file for bankruptcy, the consumer must first gather all necessary documents he or she needs, including paychecks, bank statements, retirement account statements, tax returns, appraisals for real estate, vehicle registrations, and any other documents he or she has relating to debts owed or assets owned. The filer must also complete a credit counseling course before and after filing. The fee to take these courses is normally $50.

Additionally, the filer will need to fill out all bankruptcy forms, including the petition to file in bankruptcy court. Filing fees accompany these forms, and the fees and all documents will be filed with the court and forwarded to the bankruptcy trustee.

After the case is initiated, the filer will need to attend a meeting with his or her creditors, along with the bankruptcy trustee. This normally is a month or so after the case is filed.

Certain mistakes during the initial process can lead to the court dismissing the petition. One of the biggest of these mistakes is to be dishonest or misleading in the disclosure of assets and debts the filer has. Not only will failing to disclose assets result in the person’s case being dismissed, but this lapse in honesty can result in the filer facing criminal charges.

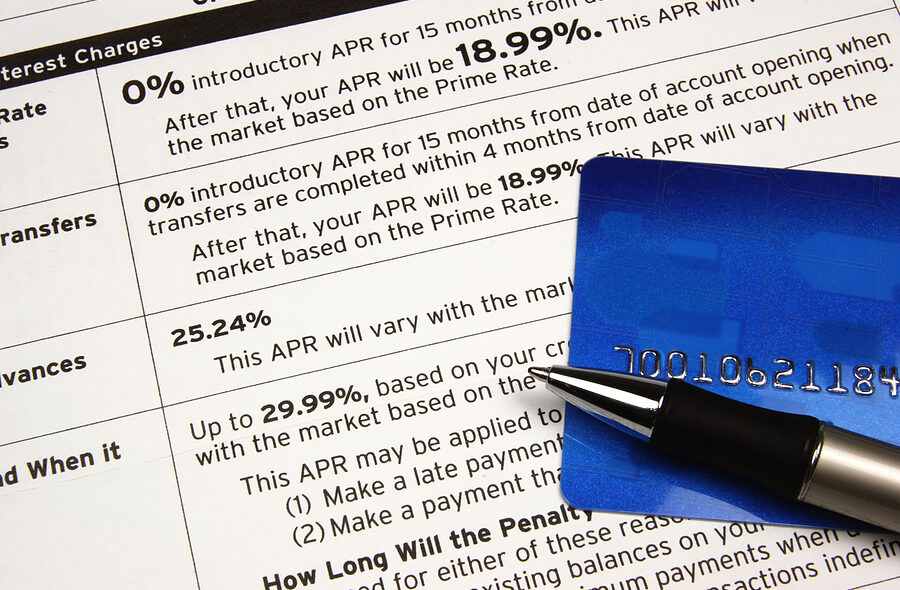

The court will also scrutinize any debts the filer incurred just before filing. Maxing out credit cards prior to filing with the intention that these debts will be discharged will not be looked upon favorably by the bankruptcy court either.

After receiving a bankruptcy discharge, the filer should take steps to ensure that they do not end up in the same situation in just a few years. Some helpful steps include the following:

- Creating a realistic budget and following it as closely as possible.

- Establish emergency savings. A good rule of thumb is to make sure a savings account has at least one month’s worth of income to cover expenses in the event of the unthinkable.

- Open a secured credit card account, using it to pay for expenses that can be paid in full every month. Over time, this account will help establish a positive credit history.

- Continue to pay all bills on time.

- Get a credit report regularly to ensure that any debts that were discharged in bankruptcy are no longer on the consumer’s profile.

These steps allow the consumer to create a pattern of paying all bills on time, which, over the course of time, will reflect positively on the person’s credit report. While a bankruptcy case does put a dent in an individual’s credit score, eventually this positive pattern will allow the consumer’s score to rebound to a respectable figure.

If you have questions on this topic or are in financial crisis and considering filing for bankruptcy, contact an experienced Miami bankruptcy attorney who can advise you of all of your options. As an experienced CPA as well as a proven bankruptcy lawyer, Timothy Kingcade knows how to help clients take full advantage of the bankruptcy laws to protect their assets and get successful results. Since 1996 Kingcade Garcia McMaken has been helping people from all walks of life build a better tomorrow. Our attorneys’ help thousands of people every year take advantage of their rights under bankruptcy protection to restart, rebuild and recover. The day you hire our firm, we will contact your creditors to stop the harassment. You can also find useful consumer information on the Kingcade Garcia McMaken website at www.miamibankruptcy.com.

SOURCE:

What experts say to do before, during and after filing for bankruptcy (cnbc.com)